All practitioners should use the latest version of the form and submit separate forms for spouses on joint returns to avoid the form's being rejected by the IRS. Of course, the CPA must balance the administrative burden of monitoring Forms 2848 for every return prepared for every client with the risk that a client will neglect to notify the CPA of a pending IRS examination for one or more returns.Īn executed Form 2848 is mandatory for IRS employees to discuss taxpayer matters with a practitioner. The IRS announced on May 20, 2016, that all initial contacts with taxpayers to commence examinations will be made by mail. If the taxpayer has designated a representative, both parties will receive the letter, and then subsequently the IRS will make telephone contact. Thus, the precaution of executing a Form 2848 as part of the preparation process would protect against situations where clients neglect to inform the CPA they have been contacted by the IRS to commence an examination. In addition, having a Form 2848 on file will allow the practitioner to be informed of any audit action by the IRS on the return that is included on the Form 2848. Having a Form 2848 in effect should help minimize these notices. 6662 accuracy- related penalty because of an omitted information return. The authors frequently see matching notices such as CP2000 (which the IRS sends when the income or payment information it has on file does not match what was reported on the tax return) for underreported or missing items of income, which often results in a Sec. This is especially true for taxpayers with substantial complex financial products, brokerage transactions, and deficient recordkeeping. Due- diligence concerns may require obtaining an account transcript showing items such as the estimated tax payments and withholding reported under the taxpayer's Social Security account number (SSAN) and the various Forms 1099 reported under the taxpayer's SSAN to accurately report all information for the taxpayer. In recent years, many practitioners have been obtaining Forms 2848 as a standard and cautionary procedure in the course of preparing income tax returns to enable access to return information filed with the IRS on behalf of clients and to monitor any IRS correspondence that may arise after the returns have been filed.

#Form 2848 irss professional

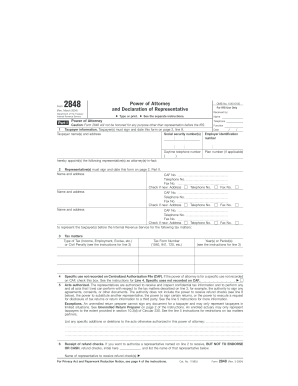

This column discusses some of the rules regarding preparation of Form 2848 and also addresses professional ethics issues that arise in dealing with the form. In addition, many states have their own version of a power of attorney (POA) form, and practitioners should be aware of these when dealing with state revenue departments. The complexity of tax laws and problems in dealing with the IRS require tax practitioners to rely on Form 2848 more frequently. Tax practitioners increasingly find Form 2848, Power of Attorney and Declaration of Representative, to be an integral component of providing professional service to taxpayers, whether that service is in tax compliance or correspondence and controversy representation.

0 kommentar(er)

0 kommentar(er)